Millionaires Tax Advances, AI Bill Dies | Leg Update 5

Not a WFSE member?Join your unionin speaking up for our jobs, families and communities.

The Millionaires Tax passes the Senate — first hearing in the House is Tuesday February 24!

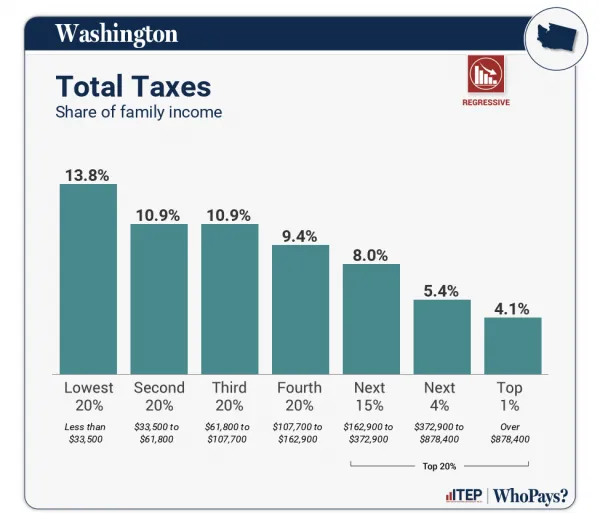

The tax would only apply to income over $1 million dollars, and some of the roughly $3.5 billion in revenue will be used to reduce taxes and increase affordability for working families.

The rest would help fix our upside-down tax code and pay for the services our members provide.

It's critical we get this bill passed.

When contract negotiations kick off in April, what we're able to accomplish in terms of compensation and maintaining our benefits will be decided by how much revenue the legislature decides to raise.

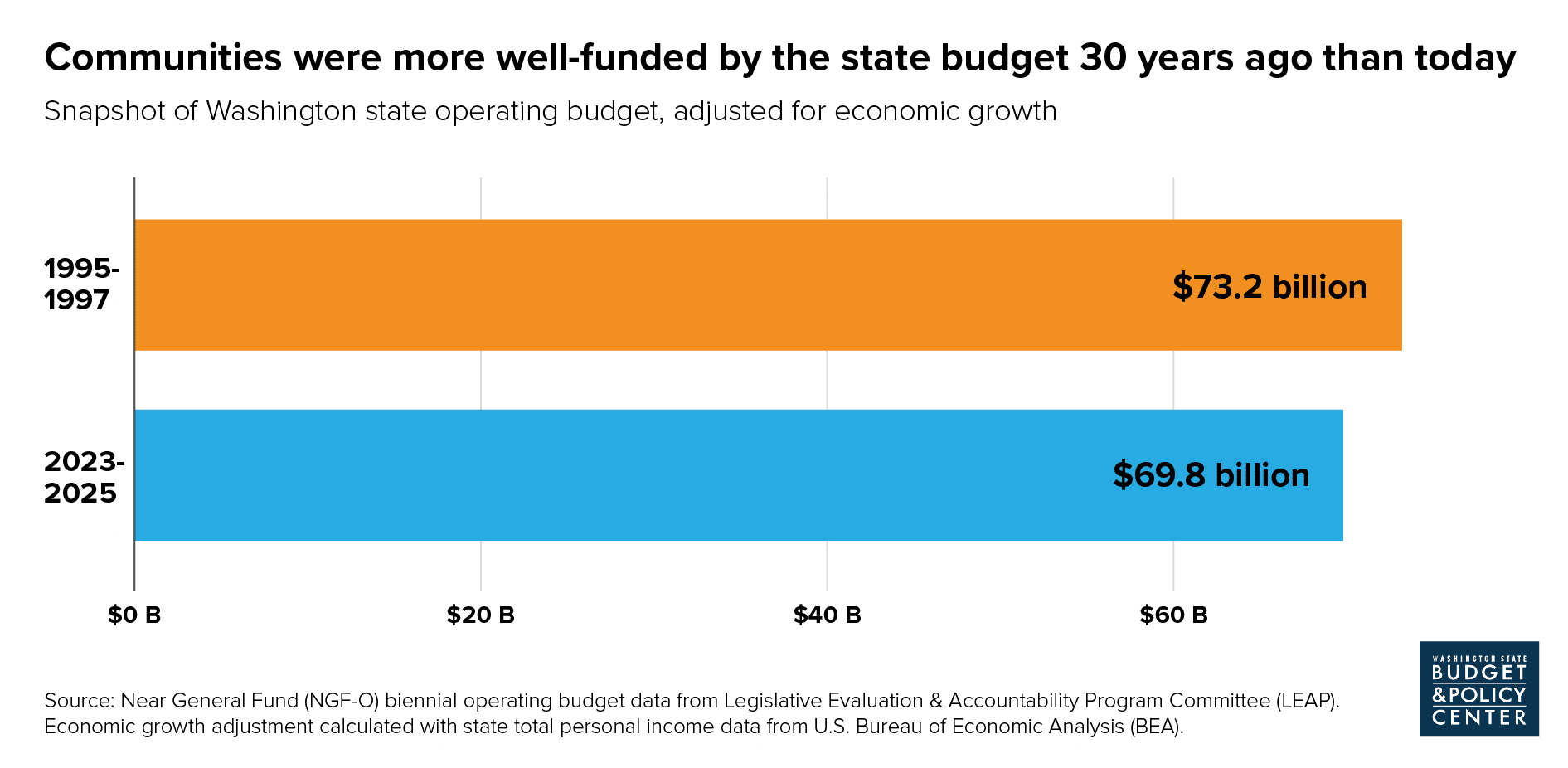

The services we provide will never be fully funded, we'll never be paid what we're worth, and Washingtonians will always have unmet needs until we fix the structural budget deficit.

Some amendments were made before the Senate passed it, including:

- Exempting businesses with gross revenues of $300,000 or less from paying the B&O tax, more than 70% of small businesses

- Repeals sales taxes on retail services, which were enacted as part of the new revenue package in 2025

Governor Ferguson has indicated he wants further changes before he'd be willing to sign it into law, including:

- Expanding eligibility and benefits for the Working Families Tax Credit

- Expanding the provision in the bill that removes sales tax on hygiene products to diapers and other baby products

- Creating several "sales tax holidays" that would allow Washingtonians to purchase items less than $1,000 with no sales tax

But first we need it to pass out of the House.

Actions to Help Pass the Millionaires Tax

- Sign in PRO by 2/23. Under organization, put WFSE member or leave it blank. Do not put your employer.

- Send a letter of supportfor the Millionaires Tax to your representatives.

- Go to your legislator's town halls. Click the link to find dates and sample questions to ask. If you are going, ask your WFSE Council Rep how you can get signs and buttons.

- Download the Millionaires Tax Info Sheet

Until Next Year, AI Bargaining Bill!

One of our highest priority bills, HB 1622, would have given public workers the right to bargain over the implementation of AI if it would impact pay or performance reviews.

It did not receive a hearing, but the prime sponsor Rep Parshley will be bringing it back next year during a much longer legislative session, and we'll be behind it 100%.

Click here to find the status of other priority labor bills here from the Washington State Labor Council. WFSE's priority bills are on our landing page here.

So You Think You Understand Our Upside-Down Tax Code?

You probably know that the rich pay a smaller share of their income in state and local taxes that the poor in Washington state, and that's why our state budget is in a seemingly constant state of deficit.

Our members experience this inbalance as constantly increasing workloads, caseloads, and fewer people to do more work.

1. Did you know that the state operating budget is actually smaller today than it was 30 years ago, when adjusted for inflation and economic growth?

Comparing dollars to dollars without taking inflation into account doesn't make sense, but many continue to do it.

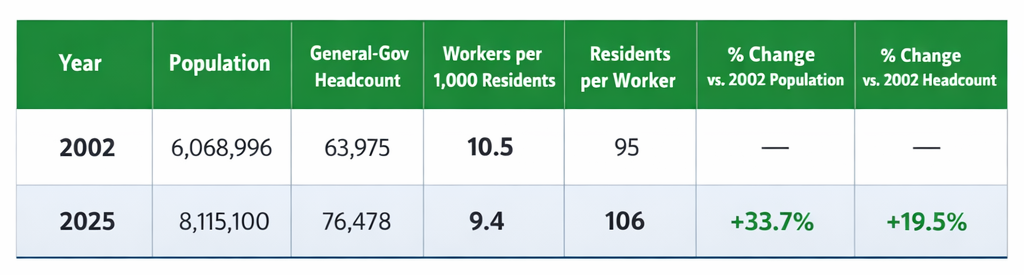

2. Did you know that there are fewer state employees to support each Washingtonian than there were 23 years ago?

It makes sense when you consider that returns on the things we tax here in Washington are flat or shrinking, like sales and excise tax returns. Things that are growing like corporate and personal wealth are not taxed.