WA's Upside Down Tax Code and Structural Budget Deficit

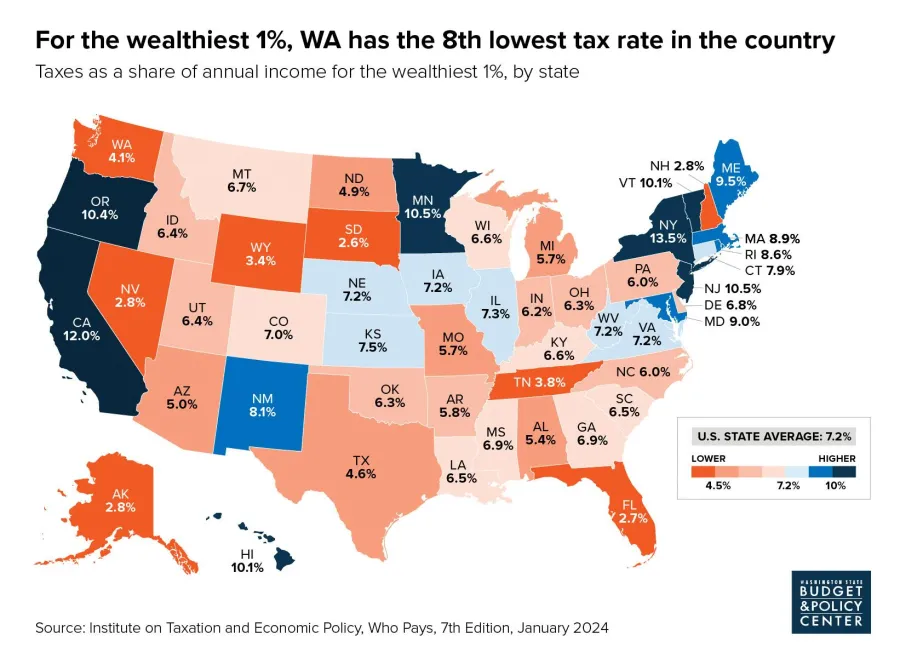

Washington state is next to last in the nation when it comes to tax fairness. We are 49 out of 50.

Our current budget crisis is in large part a direct result of our state’s inequitable tax code that relies on those with the least to pay the most.

- Send a message to your elected officials to fix our upside-down tax code!

- Get involved in our 2026 legislative session to win a #WashingtonForAll, not just the rich.

Every one of our members knows what the impacts of this upside-down system look like on the ground:

- There is a $1 billion maintenance backlog in our State Parks. Costs balloon the longer projects are deferred, and in many cases prevent our Parks from generating the revenue they should be generating.

- A workload study at the Department of Corrections found that they are down 200 positions, and there is a backlog of 13,000 warrants out for people who have violated supervision.

- Workers injured on the job face delays in getting compensation because case managers at the Dept of Labor and Industries can’t keep up with the workload.

- Assaults are a daily threat for DCYF child welfare workers and employees in our juvenile rehabilitation centers and behavioral health institutions due to short staffing and overcrowding. And it’s not just worker safety that suffers when we don’t have enough people to do the work Washington needs done.

- The youth in juvenile rehabilitation facilities suffer because there’s barely enough staff to keep the facilities open, let alone to provide rehabilitative programming they’re there to receive.

- Short-handed WSDOT highway maintenance crews mean more close calls with motorists and delays for the travelling public as minor maintenance is deferred and small problems become big problems that require closures.

Doing more with less year after year is not a good way to run a state or take care of people.

Every one of our members knows how much better their work could be done with more staff and resources, and how drastic budget cuts would harm the folks who depend on your work.

Tell your elected officials! Help us win a Washington for All, not just the rich!

Our Structural Budget Deficit

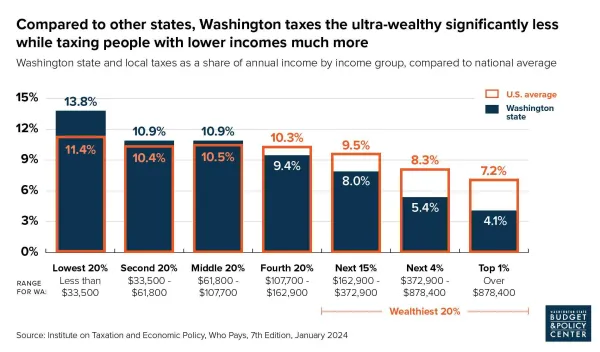

In Washington, we tax things that aren’t growing, like consumer spending by lower- and middle-class folks. We don’t tax things that are growing, like individual and corporate wealth.

The state’s revenue (income) can’t keep up with our needs (spending requirements). That creates a structural budget deficit.

The sales tax makes up half of all state revenue.

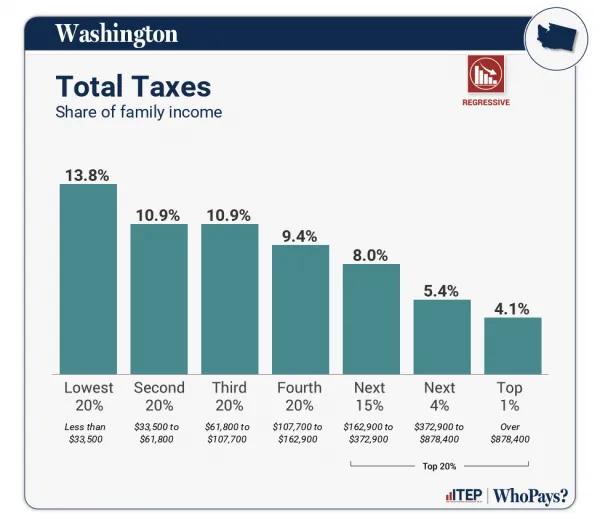

Reliance on the sales tax allows rich people to get off easy and forces poor people to foot the bill, because whether you’re rich or poor, you only need one refrigerator, you only need so much food, and so on.

Sales tax returns are tailing down, as are real estate excise tax returns as homes sales slow due to rising interest rates and unaffordable home prices.

Wealth by our state’s top earners and corporations, on the other hand, is growing. But we don’t tax that.

Powerful special interests are flooding Olympia right now trying to convince the legislature to balance the budget on our backs rather than balance our tax code.

They have spent decades helping to maintain an upside-down tax code that requires us to pay a higher share of our income in state and local taxes than they do.

And they're constantly trying to evade the few taxes they do pay in our state.

In November of last year, Washingtonians defeated a tax cut for the richest 4,000 households – literally, just for them – at the ballot box along with two other billionaire-backed initiatives would have doubled the budget crisis our state is contending with.

The broad rejection of these initiatives – with 64 percent of voters rejecting the billionaire tax cut – sends a clear message that we don’t want our representatives to cut the programs we rely on. We want them to ask the wealthy and the most profitable corporations to pay what they owe.

Lawmakers should see the election results as encouragement to continue their work to make our tax code more just and fair for all Washingtonians. They must avoid cuts that will be harmful to kids, families, and working people and find other streams of progressive revenue that balance our state budget.

Even a modest 1% wealth tax on those with wealth exceeding $100 million, which would be paid by approximately 3,400 individuals, could generate $10.3 billion in the next 4 years.

The wealth tax is just one option of many currently at our legislators disposal. It's up to our legislators to choose the best options. We just need to urge them to create a budget that meets the needs of everyone in Washington, not just the rich.