Bulls-eye on outsourcing transparency bill (1851)

Business community gangs up our priority outsourcing transparency bill

Our priority bill to bring transparency and accountability when a state agency wants to contract out state employee work has a bull’s-eye on its back as the business community lined up to try to kill it at a rare House hearing Saturday.

This is our Taxpayer Protection Act (2SHB 1851) that actually passed the House in 2017 on an overwhelming vote of 69-28. But businesses were relatively quiet then because they knew the Republican majority in the Senate would kill it. And they did just that after one Senate hearing.

But now that the Senate majority has changed, the business community is coming out of the woodwork in opposition because they can’t count on the Senate Republicans to kill the bill anymore.

At the House Appropriations Committee hearing on Saturday (Feb. 3), the Big 7 heavy hitters in the business community all lined up to oppose this good bill in the face of the Federation’s strong – and renewed – arguments for the bill.

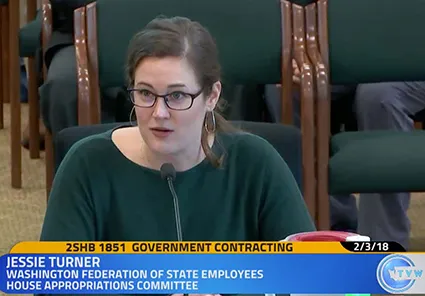

AFSCME Council 28 (WFSE)-initiated Taxpayer Protection Action (TPA) would bring “good business practices” to the decision-making process when a state agency considers outsourcing work, said Jessie Turner, the Federation’s TPA lobbyist.

“To be clear, the bill does not mandate a decision about whether or not to contract out,” Turner told the committee. “The bill simply asks the agency to document the decision-making process....

“We support the goals of this bill, offering a consistent approach and analysis for each state agency when making critical decisions.”

The business organizations that at opposed the bill at Saturday’s hearing were:

Associated General Contractors of Washington; Washington Construction Industry Council; American Council of Engineering Companies of Washington; American Institute of Architects; Associated Builders and Contractors; Independent Business Association; and Architects and Engineers Legislative Council.

These and other business interests are also working behind the scenes to kill the Taxpayer Protection Act (2SHB 1851).

The bill must pass the House Appropriations Committee by Tuesday, Feb. 6 – unless those corporate special interests get their way.

Why are these powerful corporate interests doing this?

It’s clear they want to profit from increased outsourcing — and use their wealth and power to achieve that goal.

But they won’t get their way if Federation members do what they do best: Work to pass 2SHB 1851, the Taxpayer Protection Act.

CALL TO ACTION:

- Call the Legislative Message Center at 1-800-562-6000 and urge your two House members to bring 2SHB 1851 to a vote of the House Appropriations Committee and then to pass the bill on the floor of the House.

It’s not about protecting corporate special interests. It’s about transparency and accountability in state contracting.

WFSE TALKING POINTS

HB 1851 – Taxpayer Protection Act (“Smart Outsourcing”)

PLEASE SUPPORT HB 1851. Not acting on the bill allows inconsistent contract monitoring, untracked cost over-runs, and other questionable contracting practices to continue. The public deserves a more complete understanding of how their tax dollars are being used, and the confidence that each dollar is being used effectively and efficiently.

Background

- State agencies are subject to reporting requirements and this information is available for review and inspection by the public. State contractors are not required to follow the same requirements though tax dollars are used for those goods or services.

- The state contracts for more services than it provides in-house; state contracts are NOT systematically being monitored for performance, there’s no comparison between initial contract cost and final total cost, or if the goals of the contracting are actually achieved.

- Taxpayers have little say over how tax dollars are spent, and no say on actions taken by private contractors who control the state’s vital public services.

SOLUTION: HB 1851 – Taxpayer Protection Act

Does not limit outsourcing, but requires a consistent, smart approach and analysis.

- Compares the cost of the service by the state in-house vs. the cost of the service if outsourced. This analysis will help demonstrate “the best bang for our buck.”

- Creates accountability and transparency measures for government contracts.

Increases accountability by ensuring proper contract monitoring and enforcement occurs, including required periodic review during the life of the contract. The contracts must include performance measures, and a cancellation clause for the worst cases of non-compliance.

Comparison between the initial contract entered into, and the end result. Was the service completed within budget, on time, did we achieve what we set out to do? Was it a good deal? Should we do it again?