Lobby for 2026 Worker Priorities — Help Win a Washington for All!

Jump to:

- House Vote THIS WEEK: Tell Your Rep to PASS the Millionaires Tax

- More Actions

- Our Priority Bills

- Weekly Legislative Updates

- Learn about Our Upside-Down Tax Code

What we're able to pass this legislative session (January 12 – March 12) will determine how much money there is to negotiate for when we enter contract negotiations in the spring.

It will determine if we’re even able to protect the gains we made at the bargaining table last year.

Remember, no workforce has more at stake in the decisions made by elected officials than us.

Big decisions that impact our livelihoods will be made in Olympia starting in January. With your union you have a seat at the table.

Take Action

Send Your Elected Officials a Letter: No Community College Closure or Higher Ed Cuts

The House and Senate budgets released February 23 included across-the-board cuts of 1.5% to all four-year schools and community colleges.

But the most concerning item is a proviso in the House budget that asks for a recommendation to close at least one community college or technical college by November 1 of this year.

📣 Take Action: Tell Lawmakers No to Higher Ed Closures and Cuts

It's critical to contact our elected officials now as they are negotiating their way towards a consolidated budget that's due on March 12, the last day of session.

Learn more about the cuts and read the proviso in full in our legislative update: Community College Closure, Budgets Released | Leg Update 6

Tell your House member to VOTE YES on the Millionaires Tax to fund vital programs.

The Millionaires Tax proposal would tax individual earnings over $1 million a year at 9.9% and generate $3.7 billion in revenue to fund the critical our members and other public servants provide.

Millionaire's Tax would fund tax cuts for working families

The proposed tax wouldn't only increase taxes for the richest 20,000 Washingtonians; it would also lower taxes for working families:

- No sales tax on grooming and hygiene products like shampoo and deodorant.

- Tax relief for small businesses (65% of businesses in the state)

- Expand the Working Families Tax Credit

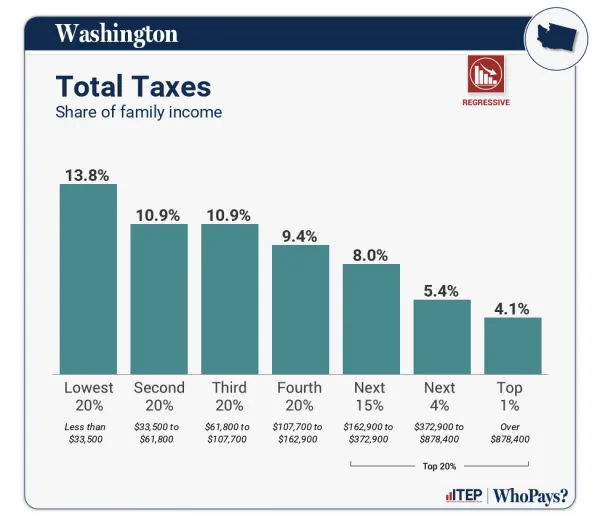

With one of the most upside-down tax codes in the country, this tax would be an important step in rebalancing our tax code and stabilizing our state budget.

Households with income in the bottom 20% pay 13.8% of their total income in taxes, while those with income in the top 1% pay only 4.1%. Only Florida has a more regressive tax structure than Washington.

Click here to send your elected officials a message to pass the Millionaires Tax.

Download the Millionaires Tax Info Sheet

Weekly Legislative Updates

Beginning the week of January 12, updates on our union's legislative priorities will be shared two ways every week:

- Via email to anyone subscribed to WFSE emails and posted below.

- Every Thursday at 5pm with our Legislative and Political Action Team on Teams (dues-paying members only)

If you are not receiving WFSE emails, you can subscribe here.

Our Positions

- No cuts to essential public services or jobs

- Preserve and fund our institutions

- Raise progressive revenue — tax the wealthy and corporations

- NO take-aways or collective bargaining restrictions

Our Priority Bills

WFSE PRIORITIES — PASSED OR READY FOR A VOTE

- SB 6346 – Establishing a tax on millionaires. [Senate Rules Committee]

- HB 2091 – Requiring public employers under chapter 41.80 RCW to provide employee information to exclusive bargaining representatives. [House passed 93-1]

- SB 5944 – Concerning language access providers’ collective bargaining. [Senate passed 44-5]

- HB 2249 – Amending the state civil service statutes to include Washington technology services. [House passed 85-10]

- HB 2411 – Authorizing shared leave for hate-crime victims and absences due to immigration enforcement actions affecting the employee or a relative. [House passed 60-36]

WFSE PRIORITIES — DEAD

- HB 1622 – Allowing bargaining over matters related to the use of artificial intelligence. [House Rules Committee]

- HB 2391 – Concerning disclosure of lists of individuals under the Public Records Act.

- HB 2622 – Setting comparison factors for interest arbitration for correctional employees regarding wages, hours, and working conditions.

- HB 2630 – Concerning collective bargaining for state employee job classifications.

- HB 2678 – Concerning caseload forecasting for adult protective services.

- SB 5379 – Granting interest arbitration to certain Parks and Recreation Commission employees.

- SB 5439 – Directing divestment from thermal coal by the State Investment Board.

- SB 6109 – Prohibiting investment of State Investment Board funds in private detention facilities.

- SB 6304 – Incorporating responsible investment principles into State Investment Board decision-making.

WFSE PRIORITIES — NOT YET DEAD BUT DYING

- HB 2100 – Establishing an excise tax on large operating companies’ payroll above a threshold to fund services via the Well Washington fund.

- SB 5797 – Enacting a tax on financial assets (e.g., stocks and bonds) to support public schools.

Creating a Washington for All, Not Just the Rich

Everyone should contribute to the services we provide

The state budget should not depend on the spending habits of poor and working families who are barely getting by. But that’s what we do here in Washington.

Because half of our state budget relies on sales tax, the richest 1% in Washington pay about 4% of their income in taxes. The average WFSE member pays nearly three times as much, around 11%.[1]

The result is boom and bust budget cycles where our pay and the services we provide are never adequately funded.

Meanwhile, the huge profits enjoyed by the super-rich and the largest corporations in our state are not taxed and do not go towards the services we all depend on.

Our message is simple: Everyone in Washington should have access to and benefit from public services, and everyone should help maintain them.

We want a Washington for all, not just the rich. That means shared responsibility for the services we all depend on.

Learn more about our upside-down tax code here and from our allies:

[1] https://itep.org/washington-who-pays-7th-edition/