Federal Cuts and Our Jobs: Here's What We Know

STOP! Have you sent a letter to tell your elected officials to save public services and balance our tax code?

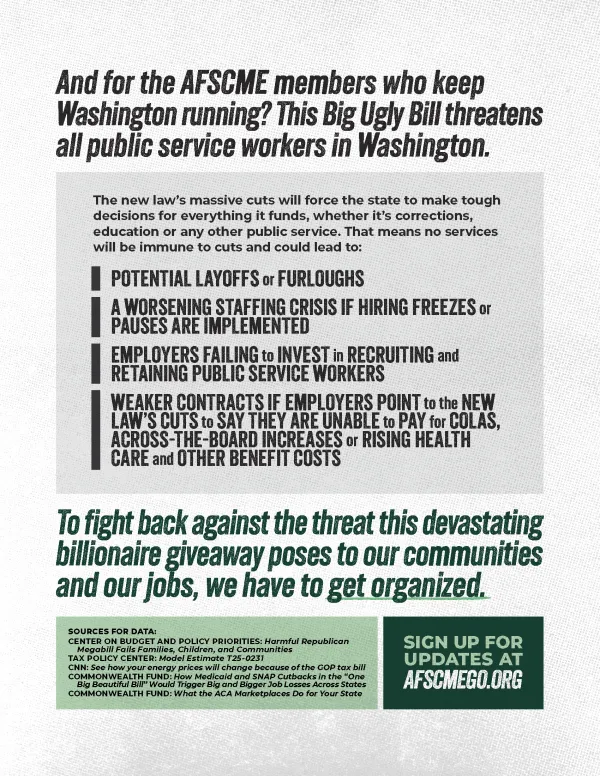

What we do now will determine how much money there will be for public services when we enter contract negotiations in spring 2026.

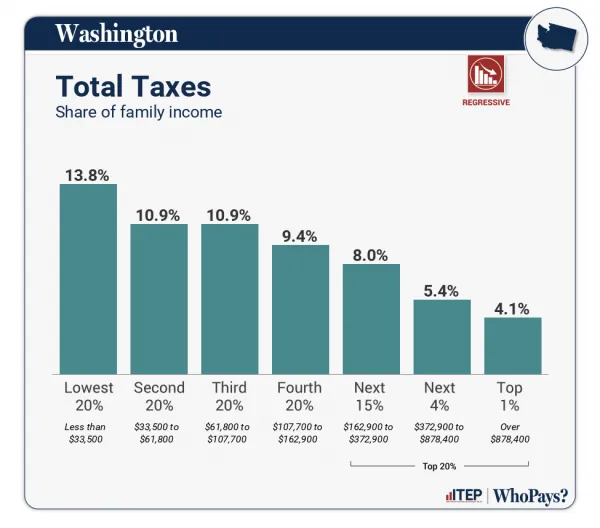

Every attack on working people at the federal level brings into sharper focus the need to balance Washington state’s inefficient and upside-down tax system.

The recent cuts to Medicaid/Apple Health are no exception.

The exact impacts to the places where our members work is not yet clear. Governor Ferguson and Attorney General Nick Brown are going through the 1,000+ page bill with a fine-toothed comb to make determinations about how our state agencies, colleges and universities will be impacted.

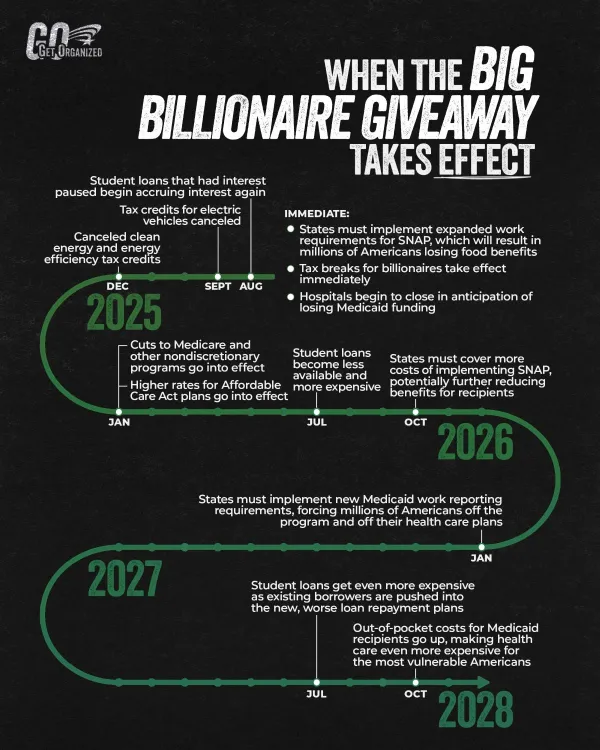

Further complicating matters, the Apple Health/Medicaid cuts are phased in in stages starting in 2026 and continuing through 2028.

We'll face the brunt of their impacts during the 2027 legislative session.

Here's what we do know about the $1 trillion cut to Medicaid, the $1 trillion tax break for the richest 1% of Americans, and how it will impact our jobs and services.

Open the fact sheets above as a PDF by clicking the link below.

Our state budget should not depend on the spending habits of poor and working families who are barely getting by. But that’s what we do here in Washington. Our budget relies almost 50% on sales tax returns.

The result is boom and bust budget cycles where our pay and the services we provide are never adequately funded.

We're still reeling from the largest budget crisis in our state’s history — a $16 billion shortfall — which was caused by a slight downturn in spending due to inflation and tariffs.

Meanwhile, the huge profits enjoyed by the super-rich and the largest corporations in our state are not taxed and do not go towards the services we all depend on.

The federal cuts signed into law on July 3 take a highly inefficient and unfair tax system here in Washington and stretch it even further toward a breaking point.

If ever there was a time to ask the super-rich in Washington to pay the same share of taxes as we do, it's now.

Our message is simple:

Everyone in Washington should have access to and benefit from public services, and everyone should help to maintain those services.

We want a #WashingtonforAll, not just the rich. That means shared responsibility for the services we all depend on.

There's no reason why a millionaire or billionaire should contribute less to our state than a WSDOT maintenance mechanic, a DOH epidemiologist, or a food service worker at one of our community colleges. Especially when many public servants are struggling to afford to live in the communities they serve.

Federal Cuts: Money from Our Pockets to Billionaires' Pockets

20,000 WFSE members' jobs are funded by federal dollars.

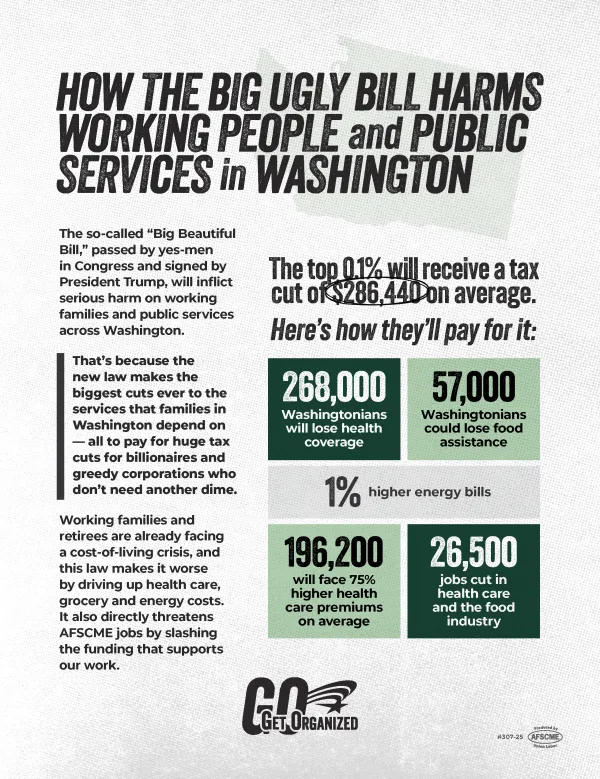

The "Big Awful Bill” passed by anti-worker extremists in Congress cuts $1 trillion from Medicaid, which is called Apple Health in Washington.

It gives that Medicaid money—which funds nursing homes, rural hospitals, and the services many of us provide—as a $1 trillion tax break to the top 1 percent of taxpayers over 10 years.

Nearly half of those tax breaks—$500 billion—go the the richest 200,000 people making over $2 million a year.

Jump to full data for higher education, taxes and state budgets

A $4 billion hole in Washington's budget every year

In Washington, we can expect roughly $40 billion in cuts from Apple Health/Medicaid over the next 10 years. Those lost federal funds — around $4 billion a year — will need to be found somewhere.

A state budget already strained by the super-rich not contributing in Washington’s will be strained even further by the huge tax cuts for the top 1% at the federal level.

Our pay and our benefits will be on the line yet again, and yet again we’ll need to pressure our elected officials to FINALLY fix our tax code, the second-most unfair unfair in the country.

Here’s what we do know:

Washington’s estimated annual loss of $4 billion means it’s more important than ever before to finally fix our upside-down tax code. Everyone needs to begin contributing to the services we provide, and that includes the super-rich, who pay just a fraction of what the rest of us do.

You can send your elected officials a message here.

What's next:

It’s critical that we balance our tax code before we reenter contract negotiations again in the spring of 2026. Otherwise we'll be fighting for a piece of a much smaller pie and be lucky to keep what we have right now.

We’ll have our opportunity to call for progressive revenue either in a special legislative session this fall or during the regular legislative session in January.

In September, we’ll get a better sense of how the economy when the next revenue forecast comes in. The previous forecast saw projected returns drop by $1 billion compared to March. If the returns are bad enough, we may be called into a special session in October.

During the 2026 legislative session, we’ll be called to defend the new taxes on large business and high net worth individuals when anti-worker billionaires run their usual slate of initiatives. We defeated these last time in resounding fashion, but we'll have to do so again.

In April of 2026 we'll have our Endorsements Conference. All PEOPLE members will be able to interview and vote on who our union endorses. It's critical that we have as many members involved as possible to endorse candidates who truly value public services and will put us first as they will be voting on whether to fund our 2027-2029 contracts.

We’ve overcome the odds before. Together, we can create a #WashingtonForAll, not just the rich, with a strong safety net and fully funded services.