ALERT: Deadline extended to Oct. 14, but don't wait.

Begin now by visiting the NW Benefit Advisor homepage for WFSE.

That's why the State of Washington is administering a state-provided long term care benefit funded via a new payroll tax, starting Jan 1, 2022.

The tax applies to all W-2 employees working in WA state. You will pay 58 cents of every $100 of W-2 income.* Take your annual salary and multiply by 0.0058 to calculate. (A person earning $40,000 per year would pay an annual tax of $232.)

Under current law, you have one opportunity to opt out of this tax by having a private long-term care insurance (LTCi) policy in place by November 1st, 2021.

*(tax can increase every 2 years)

WFSE has another option.

Interested in enrolling in a private life insurance plan with a long-term care benefit rider in lieu of paying the new payroll tax? A private plan may or may not be the best option for you.

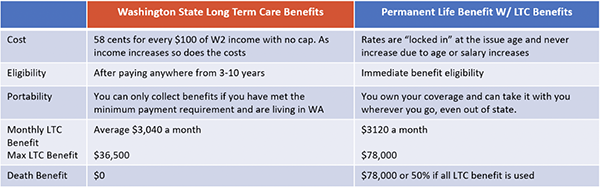

WFSE/AFSCME Council 28 is working with NW Benefit Advisors to provide members with the affordable option to purchase a permanent life benefit with long term care. This plan provides a long term care benefit funded by life insurance, so you get two benefits in one. Even if you use the long term care benefits, you will still have a death benefit. If you never use the long term care benefit, you still have a death benefit available. This benefit provides you with flexibility and choices. You can select a benefit amount that works for you and keep your coverage if you move, change jobs, or retire. You also get locked in rates that don't go up due to age or salary.

Consider this alternative.

If you get your own long term care coverage before Nov. 1st, you can apply for an exemption from the new payroll tax.

You must take action to determine what is right for you! The deadline to enroll in this benefit is October 14.

How to Enroll

1. Get the facts with a quick webinar.

Go to the NW Benefit Advisors landing page. Enter your email, then click “Zoom Meeting Schedule", then select "Payroll Tax LTC and Chubb Benefit" to view the video.

2. Get enrolled.

• SELF ENROLL if you have a pin

Your PIN is the last 4 digits of your Employee ID, followed by your 4-digit birth year.

Example:

Jane Smith, birth year 1957

Employee ID: CY123456

PIN: 34561957

Visit the Chubb Enrollment Site to self enroll with this info.

Check out this helpful guide on self enrollment.

• OR Enroll by Zoom appointment.

Schedule a brief Zoom appointment with NW Benefit Advisors at your convenience to get help enrolling. No Employee ID or PIN needed!

Visit the NW Benefit Advisors page. Enter your email to access the page and then select "Schedule Appointment". Having trouble? Email [email protected].

NW Benefit Advisors are available to answer any questions you may have and to help you enroll. Visit https://bit.ly/2WMoxQa or email [email protected] today.